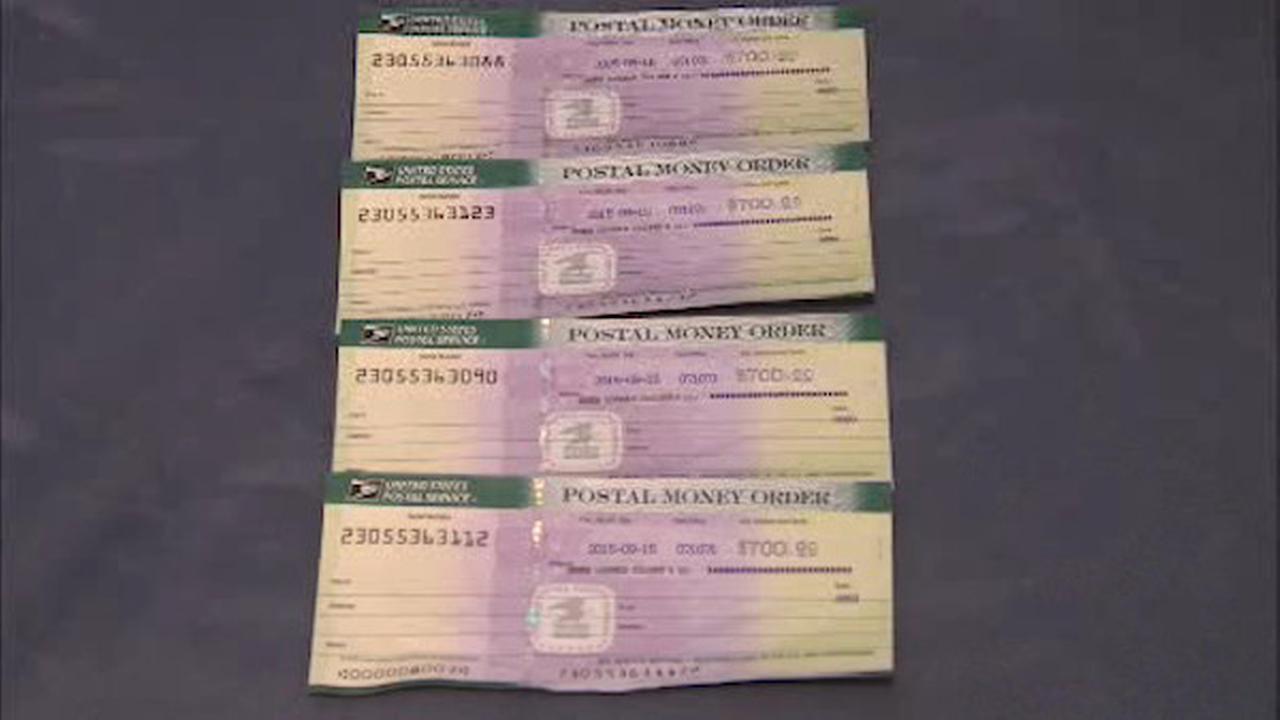

In order to cancel the cards you will need to confirm the PIN number that they are about to send you. Little do you know that the caller is actually trying to login with your username and password to your bank and the only thing they needed was the PIN number. If you gave it to them, they just received the green light to empty your bank account. Dec 12, 2019 All U.S. Postal money orders have a watermark image of Benjamin Franklin embedded in the paper. Hold the money order up to the light. Franklin's image will appear on the left-hand side of the money order and will run from the top of the money order to the bottom. If Franklin's image does not appear, the money order is not authentic. How do you know if the grant offer is legitimate or a scam? In this situation, it’s wise to recall two adages: 1) If it appears too good to be true, it probably is, and 2) there is no such thing as a free lunch. According to the U.S. Department of Justice, FBI and other Federal Agencies, fake U.S. Grant scams are on the rise across the country.

- How To Tell If Money Order Is Real Card

- How To Tell Money Counterfeit

- How To Tell If Postal Money Order Is Real

Have you heard of money orders but are not sure what they are or when they’re used? We’re here to answer all of your questions.

A money order is a secure payment method for sending a prepaid amount. Money orders are a trusted way to send cash, especially when a paper check won’t suffice or isn’t available. You may need to use a money order for a rental security deposit, a used car purchase, or for sending money internationally or through the mail. Because money orders are guaranteed, a recipient may prefer this type of payment method to a check. Fortunately, money orders are a convenient and affordable way to send guaranteed money to any recipient of your choosing.

If you’re wondering how to cash a money order, we’ve laid out the step-by-step guide below, along with a list of where to cash a money order.

How to Cash a Money Order

Follow the steps below to cash a money order successfully. After receiving your cash, you can either deposit it into your bank account or utilize the funds for what you need. Consider unloading your cash as soon as you can so you’re not carrying around a large sum of money.

- Bring your money order to a location that will cash it. You can take the money order to your bank, credit union, grocery store, and some retail stores. Review our full list of where to cash a money order in the section below.

- Endorse your money order. Wait to add your signature to the back of the money order until you’re ready to hand it over to the cashier. Then, sign the back of the order to endorse it.

- Verify your identity. Show your identification to prove that you’re authorized to cash the money order. Government-issued IDs such as a passport, driver’s license, and military card are all valid forms.

- Pay service fees. You may have to pay a fee to cash a money order, although the fees tend to be low. The fees will be deducted from the total amount of cash you collect.

- Receive your cash. Place your cash in a safe location prior to leaving the service counter. Consider securing your funds in a money belt or wallet. You may wish to notify the sender that you successfully cashed their money order.

Where to Cash a Money Order

Cashing a money order is usually convenient, as there are several places that offer this service. Depending on where you live and the places you frequent, some of the options below may be better suited for you than others.

- Bank. One of the easiest ways to receive your funds is to cash a money order at the bank. Consider cashing your money order at a bank where you already have an account so that you can securely deposit the funds immediately.

- Credit union. Similar to a bank, you can cash money orders at credit unions if you have a credit union account.

- Money transfer outlet. Several locations, like Western Union and MoneyGram, specialize in money orders. They usually offer quick service with reasonable fees.

- Post office. Wondering how to cash a postal money order? The post office securely handles money orders and is the easiest place to cash USPS money orders. You can also send out a package or purchase postage stamps while you’re there.

- Grocery store. Some but not all grocery stores allow you to cash a money order. Head to their customer service counter to ask if they process money orders — helping you to avoid a separate errand if you’re out grocery shopping.

- Check-cashing location. Stores that cash checks, whether they’re your paycheck or a payment from a friend, often provide money order services.

- Convenience store. Not all convenience stores offer a spot to cash money orders. Call ahead of time or look on their website before heading to their location.

- Money order issuer. Take a look at which entity issued your money order. You’ll be able to cash it at a store that utilizes the same company, such as Western Union, for example.

- Retail store. Certain retailers will cash money orders. Check with their customer service counter or call ahead to be sure.

When to Use a Money Order

Money orders come in handy for many situations. They are guaranteed forms of payment that can be sent and received from nearly anywhere in the world.

Here are some scenarios when you may wish to use a money order:

- You don’t have a check to make a payment

- A check is not an acceptable form of payment

- You’re sending money internationally

- You’re worried about bouncing a check

- Cash is required for a purchase, like a used car or rental security deposit

- You need to send a payment through the mail

- You don’t have a checking or banking account

- You’re making a large purchase and don’t want to have the cash on-hand

When sending a money order — whether it’s at a bank, convenient store, or post office — be sure to keep your receipt for tracking purposes. If your money order were to be lost or stolen, it’s important to have your records and receipt. Notify the recipient that you’ve sent your money order, and ask them to let you know when they receive and cash it.

While fees are typically small for money orders, they may differ from location to location. The fees also depend on how much money you’re sending and if the funds are being sent domestically or internationally. If you’re unsure how to fill out a money order, you can ask a clerk at the service counter for information.

Money orders are a secure way to send cash, especially if you don’t have a checking account or are receiving a payment in the mail. With a variety of locations available to cash a money order, it’s a convenient service to use with minimal fees. So whether you’re selling a used car or sending a payment in the mail, a money order could potentially be the right route for you.

Above all, maintaining financial stability and security is of the utmost importance. Understand where you stand financially to achieve the life you want.

Sources: USPS | The Balance | The Simple Dollar | TIME

Sign up for Mint today

From budgets and bills to free credit score and more, you’ll

discover the effortless way to stay on top of it all.

You get a call, email or letter from the federal government saying you are the winner of a free U.S. grant. All you have to do is pay a processing fee to receive the money.

How do you know if the grant offer is legitimate or a scam? In this situation, it’s wise to recall two adages: 1) If it appears too good to be true, it probably is, and 2) there is no such thing as a free lunch. According to the U.S. Department of Justice, FBI and other Federal Agencies, fake U.S. grant scams are on the rise across the country.

Here are five ways to spot a grant scam:

- Did you apply for a grant? Legitimate grants do not show up at your door as a surprise—you have to apply for them. So, if you are offered a grant you know nothing about, most likely it is a scam.

- Is a fee involved? Grant applications are usually free as they are sourced at the federal or state/county level with public funds. If you are asked to submit a fee to apply for the grant or learn more about it, there’s a good chance it is scam. Asking for an application fee is the number-one way scammers make their money.

- Is the grant for business or personal use? U.S. grants to a business or nonprofit are for the sole benefit of the company. If the grant is for school, living or other personal expenses, that’s an immediate red flag that it is not legit.

- What agency does the issuer represent? Although it may sound impressive, if they are from the Federal Grants Administration, there is no such office, so the offer is a scam.

- Were you asked for either your personal or your company’s ID or your bank account information? When asked for this info, ask the caller for the proposal in writing. Chances are you will never hear from them again.

Who Offers Legitimate Grants?

There are a few federal grant programs for for-profit companies and many state/county economic development financial assistance programs. At the federal level, the SBA has disaster recovery grants—think Hurricanes Katrina and Sandy.

Also, some agencies, like National Institutes of Health and the Defense Department, participate in the Small Business Innovation Research program which helps companies research tech innovations for possible commercialization in areas that are of interest to these agencies.

At the state/county level, there are many financial assistance programs that foster company and job creation in their respective geographic areas. These take the forms of loans, equity investments and occasionally grants.

Questions to Ask About a Legitimate Grant (OR) You Won a Legit Grant—Now What?

When you are the fortunate recipient of a legit U.S. grant, make sure you understand its purpose and requirements upfront.

How To Tell If Money Order Is Real Card

- What can the money be used for? Most grants are not general-purpose funds, to be used for whatever the company determines. They are for specific purposes that meet the mission of the grantor. Make sure the grantor’s mission and your mission are in sync.

- What portion of the grant can be used for “overhead”? Grants are provided to undertake projects and activities. It takes administrative support to accomplish this, so make sure you understand what amount of the grant can be used for that.

- What is the timing of the payments? Many grants are provided upfront, so the company has the funds in hand to pay for the work. However, some grants are paid when agreed-upon milestones are accomplished or when specific expenditures need to be reimbursed.

How To Tell Money Counterfeit

Key Lessons

How To Tell If Postal Money Order Is Real

- Unsolicited grants are often scams.

- When you have a legitimate grant, make sure you understand the terms and conditions to ensure it’s a fit with your company’s direction.