Money app terms. Borrowing with a money app is a financial commitment and knowing what you are agreeing to is important. Understanding the terms used by money apps is a good first step. Here are the most important terms you should know about. Your annual percentage rate is the interest you pay on a loan over a yearly period. Money View Loans: Personal Loan App, Instant Loan. On our Instant Paperless Loan app, you can borrow any amount starting from ₹10,000 up to ₹5 Lakhs! Our Annual Interest rates (APR) vary from 16% to 39%. & you can choose from a wide range of flexible EMI repayment plans starting from 3 months & going up to 5 years.

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

Personal loan apps are mobile tools designed to let you apply for a loan without ever setting foot in a bank.

If you need funds to help consolidate debt, pay an outstanding bill or finance a large purchase, a personal loan might make sense for you. Personal loan apps can give you an opportunity to borrow money with an online application. Remember, though — approval is not guaranteed and is based on a number of factors, like creditworthiness.

You might find applying for or managing a loan through a personal loan app to be a great way to go — as long as you choose a loan that you can afford to comfortably repay, of course.

What is a personal loan app?

A personal loan is typically unsecured and can come from a bank, credit union or other lender. Thanks to the popularization of online banking and money management tools, a group of financial companies has emerged with a focus on online lending.

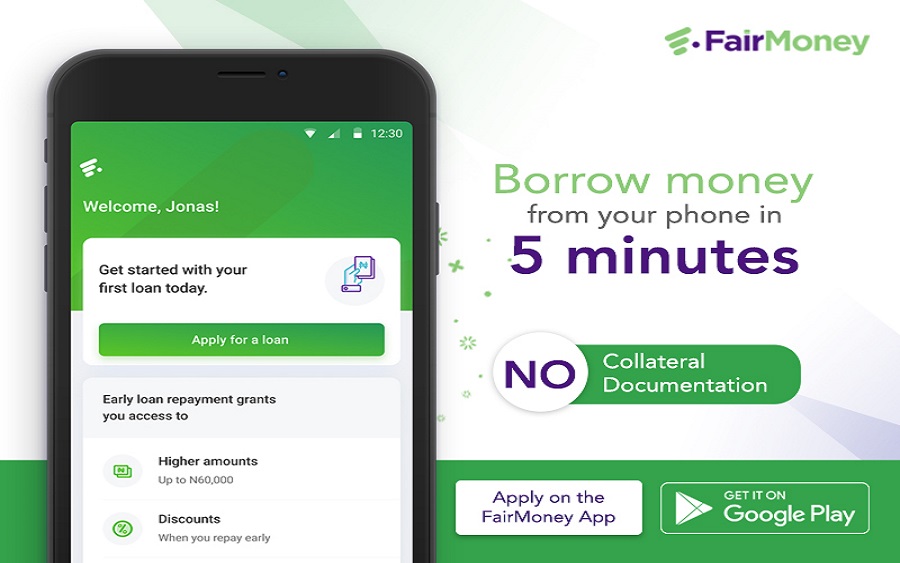

Many of these lenders offer loans through mobile apps, which are available from the Google Play store for Android phones and the App Store for iOS devices. In some cases, you can apply for and help manage the loan within the mobile app. But for some other lenders, you may need to access the lender’s website on a computer to apply.

The app to apply is typically associated with an online lender, traditional bank or credit union, and these apps can have certain restrictions. For example, if the lender doesn’t offer loans in your state you won’t be able to apply just because they have an app.

With a personal loan, you’ll have an installment loan — a loan with fixed monthly payments until the debt is paid off — if you’re approved.

While many lenders do allow you to view or manage existing loans and payments through a mobile app — and some let you apply through their mobile sites — few lenders offer the ability to apply through a downloadable mobile app.

See our picks for the best apps that loan money.

How do personal loan apps work?

While sending an application through a mobile app may feel less formal than applying through a traditional bank, it’s essentially the same process. You’ll need to indicate how much you’d like to borrow and provide identifying information to apply. Pay close attention to loan terms like interest rates and fees, including any prepayment penalty for paying off your loan early.

To get started, you’ll need to download the lender’s app for your phone. Once installed, you typically have to create an account before you can begin your application.

Some of the required details to include in your loan application generally include your name, contact information, Social Security number, annual income and your desired loan amount.

Your credit scores are one of many factors that can affect the interest rate you’ll get for most loans. Strong credit scores typically indicate a lower risk and that you’re likely to repay the loan. Lenders are generally willing to offer a lower interest rate to those with healthy credit.

If approved, some lenders will directly deposit the funds into your bank account — within a few business days, in some cases.

Should I use a mobile app for a personal loan?

If you can apply online or with a mobile app, you may find a faster and easier experience than filling out a traditional application with a paper and pen, particularly if you’re comfortable with computers and handling your finances online.

But keep in mind that while some lenders offer the entire lending experience through a mobile app, many banks and online lenders still don’t let you handle your entire loan from a mobile app. If you download the mobile app and can’t apply there, just head to the website to apply using your computer.

Be sure the mobile app is not a payday loan, unless this is the type of loan you are certain you want. These loans typically charge very high interest rates compared to traditional personal loans.

Personal loan tips

As with any kind of loan, make sure you really need that personal loan before you apply through an app. Even if money is tight, a loan with high interest and fees could leave you in a worse financial situation than where you started.

If you’re interested in taking out a personal loan, don’t skip shopping around to make sure you get the best interest rates possible for you based on your credit. Interest is the percentage of the principal that a lender charges you to borrow the money. For example, if you borrow $5,000 with a 12% interest rate, you would pay $50 in interest alone the first month. And remember, the annual percentage rate, or APR, is the cost you pay each year to borrow money, including fees.

Other potential costs to watch out for: origination fees, prepayment penalties, late payment fees and returned payment fees.

Bottom line

Applying for a personal loan with a smartphone could be faster and easier than applying through a traditional online application. But don’t get so caught up in the speed and easy access that you skip shopping around and carefully considering all loan terms.

And don’t limit yourself to just mobile apps when loan shopping. You may find better terms from a lender with a web-based or even more traditional application process.

Read More

By Louis DeNicola,Erika Giovanetti of MediafeedReal Apps That Pay Cash

|Getting money between paydays

Financial emergencies have a habit of cropping up at the worst possible time: when you’re stuck in between paychecks. You might be tempted to turn to a credit card or a payday loan, but those could rack up costly fees.

You may be able to get a portion of your next paycheck early using apps like Earnin or Dave. These paycheck advance apps let you borrow small amounts of money, often without charging interest. With some, you may just pay a membership fee or a voluntary tip.